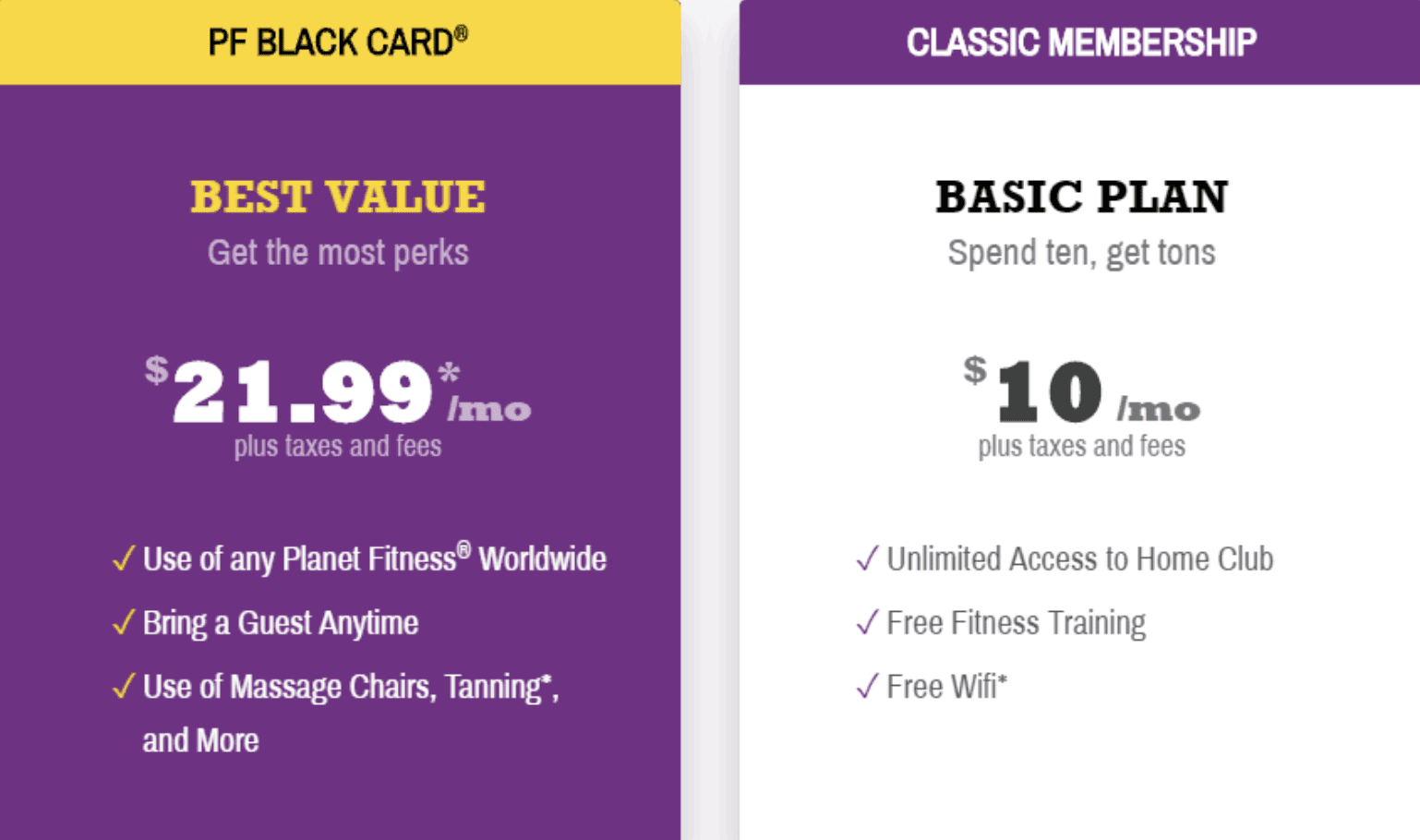

A few unusual pricing examples

Here are a couple of new (or upcoming) pricing examples you can integrate into your next lectures on Price (see Chapters 17 and 18). Students…

Here are a couple of new (or upcoming) pricing examples you can integrate into your next lectures on Price (see Chapters 17 and 18). Students…

The U.S. Food and Drug Administration (FDA) has authorized Florida to import medications from Canada, marking a significant policy shift in the United States. This…

Are you searching for some fun new examples to use in class? Innovation and new products are an important outcome of good marketing. The Time…

Have you been asked to tip in new situations? How do you handle it? I couldn’t believe it when the fast food restaurant asked for…

As you, and probably most of your students know, a few months ago, Netflix announced it would crackdown on the common practice of password-sharing. The…

In today’s inflationary economy, there are lots of stories about companies raising prices. Yet today, there are a few brands that vow to hold prices…

How many subscription services do you have? And how much do you spend on them in total each month? C+R Research asked these questions to…

Here at Teach the 4 Ps we find subscription pricing for traditional products to be unusual—but apparently growing in popularity. We have previously posted on…

I love creative marketing ideas — and especially creative pricing approaches. In recent years we have seen subscription models take off. Companies like them because…