Retailing Update…

Besides Promotion and of course social media, I might argue that retail has seen the most dramatic changes. And that change continues to come. First…

Besides Promotion and of course social media, I might argue that retail has seen the most dramatic changes. And that change continues to come. First…

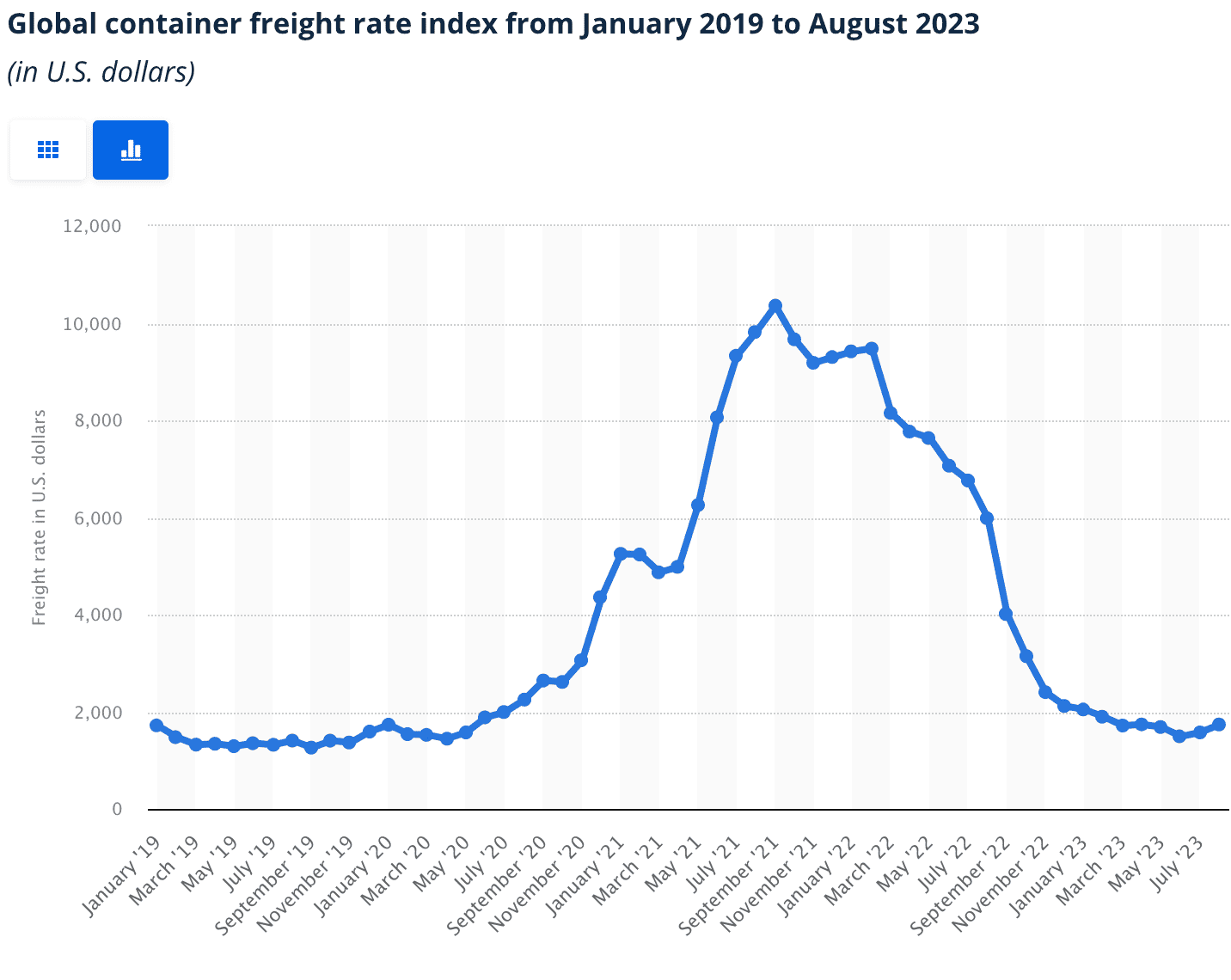

You may recall that container shipping rates skyrocketed during the pandemic. Rates jumped by a factor of 5-10x depending on the source of numbers. This…

This recent Wall Street Journal article, “Nike Broke Up With Retailers. Now It’s Trying to Win Them Back,” (June 10, 2023, non-subscribers may be able…

After years of generous and easy return policies, “Retailers Clamp Down on Returns,” (Wall Street Journal, subscription required, May 23, 2023). The bottom line –…

Will TikTok become a new retailing powerhouse? It looks like it is going to give it a try. TikTok rose from obscurity to became the…

Scott Galloway provides a short video where he shares some crazy statistics about Amazon. For example, did you know that within 45 minutes of an…

This short (9 minute) Planet Money podcast titled “Full (ware)house” covers some interesting trends in the warehouse space. One current situation is that in spite…

My kids have started talking about social e-commerce. Of course that is not the term they use, but buying via Instagram is growing fast. “Social…

Earlier this month, the United Nations’ Intergovernmental Panel on Climate Change issued its latest report on the climate. It was not encouraging and clearly points…